How you can design an employee CTC?

Though an employee can receive the gratuity amount only after 5 years, it will be deducted by the employer every year and hence it will get deducted from your CTC.

Life insurance and health insurance

Many companies provide health insurance and life insurance to their employees, the premium for which is borne by the employer and is included in the CTC. Hence it has to be deducted while calculating your take home salary.

Let us understand income tax and how it is related to salary income and salary components.

Income tax

The tax levied on one’s personal income is called income tax. Usually, an employee gets his or her salary after the tax deduction by the employer. This process is called as Tax Deduction at Source (TDS). The deducted tax amount is paid to the government by the company.

Professional tax

Professional tax is the tax charged by the state government in order to let an individual practice a certain profession. The maximum amount payable per year is INR 2,500. It depends on one’s monthly salary and also on the state in which one works. The professional tax levied varies from state to state in India.

How to calculate your take-home salary?

We have provided some easy steps to help you calculate your take-home salary, also known as in-hand salary and net salary.

In order to Calculate take-home salary, subtract the Income Tax, Provident Fund (PF) and Professional Tax from the Gross Salary.

Step 1: Calculate gross salary

Gross Salary = CTC – (EPF + Gratuity)

Step 2: Calculate taxable income

Taxable Income = Income (Gross Salary + other income) – Deductions

In order to determine the part of your income that is taxable, subtract allowances (LTA, Conveyance Allowance, HRA), professional tax, medical bills, medical insurance, tax saving investments, if any and other deductions from your gross salary.

Calculating income:

To calculate income-tax, include income from all sources such as:

- Salary (salary paid by your employer)

- House property (rental income, or interest paid on home loan)

- Capital gains (income from sale purchase of shares or house)

- Income from any business/profession

- Other sources (saving account interest income, fixed deposit interest income, interest income from bonds)

Deductions:

1. HRA

HRA received is not fully exempt from tax. HRA that you can claim is the lowest of the following:

- The total amount received as the HRA from the employer in the financial year.

- Actual rent paid in the year – 10% of the basic salary in the year.

- 50% of the annual basic salary if staying in a metro city or 40% of the annual basic salary if staying in a non-metro city.

2. Standard deduction

In Budget 2019, a standard deduction of Rs 50,000 (annually) has been introduced. Before this, there was a transport allowance of maximum INR 19,200 (annual) and Medical allowance of maximum INR 15,000 (annual), which are no longer applicable.

3. LTA

Travel cost can be claimed for tax exemption under Section 10(5), twice in a block of four years. LTA covers only domestic travel, and the amount is provided on submission of actual bills.

Step 3: Calculate income tax**

Once you have taxable income, you can easily calculate income-tax by referring to the income-tax slab and rates provided below:

Tax slab

The income tax rate is levied based on a slab system under which individuals pay taxes at different rates basis their income slab.

Income tax slabs are revised every year during the budget keeping in mind the individual taxpayers.

According to the budget announcement for the FY 2019-20, tax slab for male and female Indian resident individuals below 60 years of age is as follows:

| Net Income | Income Tax | Health and Education Cess |

| Up to Rs. 5 Lac | Nil | Nil |

| Rs. 5,00,000 – Rs. 10,00,000 | Rs. 12,500 + 20% on income above 5 lac | 4% of income tax |

| Above Rs. 10,00,000 | Rs. 1,12,500 + 30% on income above 10 lac | 4% of income tax |

*Surcharge @10% will be applied for taxable income between Rs. 50 lac to Rs. 1 crore and @15% for taxable income above Rs. 1 crore.

But with the new budget announced on February 2, 2020, taxpayers can now choose between the current and new tax regime.

Individual taxpayers have a choice between

- The current tax regime with existing income tax deductions and exemptions.

- The new income tax regime with lower tax rates and fewer exemptions.

As proposed in the Budget 2020-21, the new tax regime offers slashed income tax rates to lower the amount of tax paid, simultaneously eliminating certain deductions and exemptions.

Calculate exact in-hand salary with the help of our free take-home salary calculator.

Step 4: Calculating in-hand/take home salary

Take Home Salary = Basic Salary + Actual HRA + Special Allowance – Income Tax – Employer’s PF Contribution(EPF)

Example:

Let’s take an example to understand how to calculate take-home salary:

Meera’s CTC is Rs. 16,00,000. Other salary components of her salary structure are metioned below:

| Salary Components | Amount (annual) | Amount (monthly) |

|---|---|---|

| CTC | 16,00,000 | – |

| Basic | 6,40,000 | 53,332 |

| HRA | 3,20,000 | 26,666 |

| EPF | 21,600 | 1,800 |

| Sec 80C Investment | 1,00,000 | 8,333 |

| Leave Travel Allowance | 20,000 | 1,666 |

| Special Allowance | 5,75,324 | 47,943 |

| Gratuity | 23,076 | 1,923 |

| Professional Tax | 2400 | 200 |

Note:

*This is up to Meera to decide how much she wants to invest and claim under section 80C. The maximum deduction possible is 1,50,000. EPF amount also comes under section 80C.

We have assumed that Meera pays INR 30,000 per month as her rent.

DA is assumed to be zero because Meera is a private sector employee.

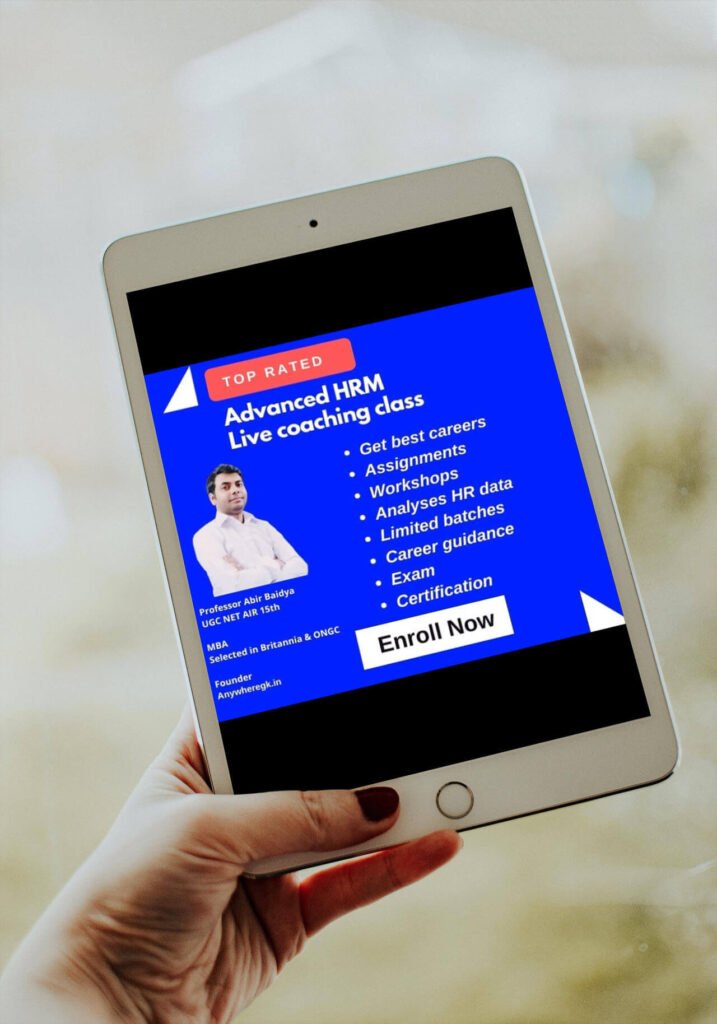

Enroll for our best Advanced HR Certifications & Advanced Data Analysis Certifications courses

Step 1: Calculating gross salary

Gross Salary = CTC – (EPF + Gratuity)

Gross salary= 16,00,000 – (21,600 + 23,076)

Gross Salary = INR 15,55,324

Step 2: Calculating taxable income

First, calculate the HRA deduction that you can claim:

HRA that you can claim = Minimum of (Actual HRA, Rent paid – 10% of basic, 50% of Basic for metro city)

= Minimum (3,20,000 , 3,60,000 – 10% of 6,40,000, 50% of 6,40,000)

= Minimum (3,20,000, 2,96,000, 3,20,000)

= 2,96,000

Taxable Income = Gross Salary – Section 80C deduction – Standard Deduction – HRA – Professional Tax

Taxable Income = 15,55,324 – 1,000,00 – 50,000 – 2,96,000 – 2,400

Taxable Income = 11,06,924

Step 3: Calculate income tax

Based on the slab rates announced in the FY 2019-20:

Income Tax = 112500 + 30% of (Taxable Income – 100000)

Income Tax = 112500 + 30% of 1,06,924

Income Tax = 1,87,347

Cess = 4% of Income Tax

Net Tax = 1,87,347 + 7494= 1,94,841

Step 4: Calculating in-hand/take home salary

Take Home Salary = Gross Salary – (Income Tax + Professional Tax)

Take Home Salary = 15,55,324 – (1,94,841 + 2,400)

Take Home Salary (Annual) = INR 13,58,540

Take Home Salary (Monthly) = INR 1,13,212

Source: Naukri.com

- Pay your all fees

- How best skills give you better employment

- How i paid Rs 10,00,000 for MBA? How to pay for MBA? | Funding Your Education: The Key to a Bright Future

Shop our merchandise